- Home

- About

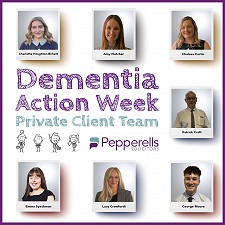

- Our People

- Business

-

Personal

- Wills and Trusts

- Conveyancing

- Divorce

- Child Contact

- Family Law

- Property Disputes (TOLATA)

- Criminal Law

- Civil Litigation

- Landlord and Tenant

- Inheritence Dispute

- Personal Injury

- Criminal Injury

- Road Traffic Law

- Adoption

- Consumer Rights

- Debt Recovery

- Injunctions

- Defamation

- Libel and Slander

- Care Proceedings

- Domestic Abuse

- Join Us

- Pepptalk

- Pay Online

- Contact

Insights, Pepptalk & News

Pepperells Limited, registered in England and Wales: No. 10244781 | Registered Office: 100 Alfred Gelder Street, Hull, East Yorkshire, HU1 2AE | Authorised & Regulated by The Solicitors Regulation Authority | Regulation Authority Numbers 636188, 638554, 638556, 647027, 636188, 807163, 818433, 8000373, 832782 and 830125. | www.sra.org.uk

Pepperells Solicitors are committed to ensuring that all Partners, Consultants and Employees give their full co-operation to the Legal Ombudsman in the event of any dispute or complaint against our firm, contact details of which can be found at www.legalombudsman.org.uk. VAT No. 365 0589 36